Content

Background on the decision

On July 19, 2023, the U.S. District Court for the Eastern District of Tennessee issued a ruling in Ultima Servs. Corp. V. Dep’t of Ag. affecting the 8(a) Business Development program. Prior to this ruling, individual Black Americans, Hispanic Americans, Native Americans, Asian Pacific Americans, and Subcontinent Asian Americans applying for the program could establish that they were socially disadvantaged by demonstrating that they held themselves out as a member of one of those designated groups. This practice has been known as using a “rebuttable presumption of social disadvantage” or “presumption of social disadvantage.”

While most 8(a) firms established their 8(a) program eligibility through a presumption of social disadvantage, other 8(a) firms were admitted to the 8(a) program because the qualifying individual owner established social disadvantage by a preponderance of the evidence (i.e. submitted a narrative as part of the original application).

In this ruling, the Court barred SBA from using the presumption of social disadvantage to administer the 8(a) Program.

Under DOJ guidance regarding the Court’s order, SBA is requiring all 8(a) participants who originally relied upon the presumption of social disadvantage in their application to re-establish their 8(a) Program eligibility by completing a social disadvantage narrative.

The 8(a) program remains open for business. SBA is encouraging its continued use as federal agencies identify small businesses to help meet critical mission needs during the end of the fiscal year, typically a time of increased usage of the program. Agencies can immediately continue to send offer letters to SBA.

Guidance and FAQs for current 8(a) participants

To receive new 8(a) contracts, an individual-owned 8(a) participant firm that previously relied on the presumption of social disadvantage to support eligibility will now need to submit a social disadvantage narrative to re-establish eligibility. All current 8(a) participants that fall under this category received a direct communication from SBA on or about Monday, August 21, 2023 detailing the process for establishing social disadvantage through a social disadvantage narrative.

8(a) participants must submit an individual social disadvantage narrative through Certify. For detailed instructions, please refer to SBA’s User Guide for Social Disadvantage Narrative Submission.

For 8(a) participants who have multiple disadvantaged individuals, each disadvantaged individual is required to submit an individual social disadvantage narrative. SBA will reach out to these firms to initiate the Request for Information (RFI) process, through which individuals will be able to submit their individual social disadvantage narrative within Certify. Please refer to SBA’s User Guide for Social Disadvantage Narrative Submission.

Once a current 8(a) participant has submitted an individual social disadvantage narrative to SBA and SBA has verified the individual’s social disadvantage, the participant will receive a Social Disadvantage Qualification letter which affirms continued participation in the 8(a) program.

Current 8(a) participants should continue to submit their annual review and continuing eligibility materials to SBA. With respect to social disadvantage, SBA will interpret the firm’s certification that it remains eligible for the 8(a) program as stating only that there have been no changes to the information the participant previously submitted in connection with its program eligibility that would affect the social disadvantage determination.

Consistent with existing regulations, 8(a) participants will need to establish social disadvantage only once for their program term, unless there are ownership/control or other changes which affect eligibility.

Helpful resources:

- SBA’s Guide for Writing a Social Disadvantage Narrative

- SBA’s Social Disadvantage Narrative Information Session Webinar hosted August 30, 2023

- SBA’s User Guide for Social Disadvantage Narrative Submission

To receive new 8(a) contracts, an individual-owned 8(a) participant firm that previously relied on the presumption of social disadvantage to support eligibility will now need to submit a social disadvantage narrative to re-establish eligibility. All current 8(a) participants that fall under this category received a direct communication from SBA on or about Monday, August 21, 2023 detailing the process for establishing social disadvantage through a social disadvantage narrative, as well as subsequent communications on throughout September, October, and November.

Current 8(a) participants who did not submit a social disadvantage narrative to re-establish eligibility were suspended from the 8(a) program on November 15, 2023. The 8(a) participant’s suspension is displayed in Certify and Small Business Search. To overcome this suspension, firms must submit an individual social disadvantage narrative through Certify to re-establish eligibility. For detailed instructions, please reach out to your Business Opportunity Specialist or refer to SBA’s User Guide for Social Disadvantage Narrative Submission.

Helpful resources:

- SBA’s Guide for Writing a Social Disadvantage Narrative

- SBA’s Social Disadvantage Narrative Information Session Webinar hosted August 30, 2023

- SBA’s User Guide for Social Disadvantage Narrative Submission

If you were originally admitted to the 8(a) program because the qualifying owner established social disadvantage by a preponderance of the evidence (i.e. submitted a narrative as part of the original application), you will not need to submit a new narrative.

All current 8(a) participants that fall under this category received a direct communication from SBA on or about Monday, August 21, 2023 clarifying that the participant has already established social disadvantage and may proceed with federal contract awards. SBA posted the Social Disadvantage Qualification letter to the participant’s documents in Certify. This letter affirms continued participation in the 8(a) program.

Current 8(a) participants should continue to submit their annual review and continuing eligibility materials to SBA. With respect to social disadvantage, SBA will interpret the firm’s certification that it remains eligible for the 8(a) program as stating only that there have been no changes to the information the participant previously submitted in connection with its program eligibility that would affect the social disadvantage determination.

Consistent with existing regulations, 8(a) participants will only need to establish social disadvantage once for their program term, unless there are ownership/control or other changes which affect eligibility.

The Court’s decision does not impact entity-owned firms, such as firms owned by Indian tribes, Alaska Native Corporations, Native Hawaiian Organizations, or Community Development Corporations. These firms will not need to submit social disadvantage narratives.

All current entity-owned 8(a) participants received a direct communication from SBA on or about Monday, August 21, 2023 clarifying that the participant may proceed with federal contract awards. SBA posted the Social Disadvantage Qualification letter to the participant’s documents in Certify. This letter affirms continued participation in the 8(a) program.

Current 8(a) participants should continue to submit their annual review and continuing eligibility materials to SBA.

How are 8(a) participants and their current contracts impacted?

- The injunction does not extend to current contracts and agencies may exercise priced options.

How can I prepare my social disadvantage narrative?

- A Guide for Writing a Social Disadvantage Narrative is available on the Certify Knowledge Base. In addition, you are encouraged to review SBA’s webinar session 8(a) information videos.

Can I use examples of social disadvantage from any point in my life?

- Yes, the examples you include in your social disadvantage narrative can be related to any time in your life but must include detail of how the incident impacted your entry or advancement in the business world. You may include examples that have taken place before or after you started your 8(a) participation.

Can I provide evidence of a social disadvantage that is different than the basis used in my original approval?

- Yes, you may use a different basis of your social disadvantage. For example, an 8(a) participant may have been approved based on their race but have more examples of their social disadvantage based on their gender.

I have a pending contract award and am required to submit a social disadvantage narrative. When must I submit one by?

- SBA strongly encourages participants to avoid delay in the submission of their narratives. Before your firm can receive new 8(a) contract awards SBA must approve your narrative to ensure continued eligibility. Submitting in a timely manner is the best way to ensure timely contract award and continued program participation. Please reach out to your Business Opportunity Specialist if you have additional questions or concerns.

If SBA determines that my social disadvantage narrative does not have enough detail, will I get a chance to revise my narrative?

- Yes, you will have an opportunity to provide more detail.

If my firm was certified in the 8(a) program before the court’s ruling on July 19, 2023, do I still have to submit a social disadvantage narrative?

- Yes. To comply with the Court’s order, SBA must now require 8(a) participants whose program eligibility was based on one or more owners using the presumption of social disadvantage to establish social disadvantage through submitting a narrative. Once an 8(a) participant has submitted a narrative to SBA, and if SBA determines that the firm’s owner(s) has demonstrated personal social disadvantage, the participant will receive a Status Qualification Letter indicating it has established social disadvantage and may continue to receive 8(a) contracts and otherwise participate in the 8(a) Business Development program. Consistent with existing regulations, 8(a) participants will need to establish social disadvantage only once for their program term, unless there are ownership, control or other changes which affect eligibility.

Once SBA approves my social disadvantage narrative, am I required to get another approval before each new contract award?

- No. Consistent with existing regulations, 8(a) participants will need to establish social disadvantage only once for their program term, unless there are ownership, control or other changes which affect eligibility.

Will SBA grant an extension to our program term?

- The 9-year term of participation in the 8(a) program is in law. SBA does not have the authority to extend a firm's participation in the program.

I submitted a social disadvantage narrative during my 8(a) application process in 2017 or 2018. Is a new narrative required?

- SBA recognizes that you may have been required to submit a written narrative in support of your individual economic disadvantage if you applied prior to 2018 and at that time any such narrative was relevant only to SBA’s determination of your economic disadvantage. A new narrative is required because SBA determined your individual social disadvantage based upon your membership in a group presumed to be socially disadvantaged. For this reason, SBA still requires you to submit a social disadvantage narrative to determine your individual social disadvantage.

I have my social disadvantage narrative ready, and I have multiple contracts on hold. I am trying to find out how to submit to SBA. What do I do next?

- You can upload your individual social disadvantage narrative through Certify. Once you log into Certify, on your dashboard you will see a red ‘Upload Social Disadvantage Narrative’ button. Click the button to upload your narrative. The button will be blue if it is uploaded but not yet approved. The button will be green if it is uploaded and approved. Also, if your firm has multiple disadvantaged individuals, they will be contacted via Certify and will submit their narratives through the Request for Information (RFI) process. Please refer to SBA’s User Guide for social disadvantage narrative submission.

I am confused about the required format for the social disadvantage narrative. Is a letter required, or can I follow the guide and submit bullet points?

- There are no specific format requirements. Please review SBA’s Guide for Writing a Social Disadvantage Narrative available from the Certify Knowledge Base.

I am in the process of completing my Annual Review. Does the court case impact my Annual Review?

- No. Thank you for working to complete your Annual Review. Please complete and submit your review as soon as possible. Contact your Business Opportunity Specialist if you have additional questions or concerns.

I am having technical difficulties or feel stuck. Who can help me?

- Every 8(a) participant has an assigned SBA Business Opportunity Specialist (BOS) to help you through the process. You are encouraged to contact your BOS for assistance at any time. To find out who your BOS is, login to your Certify portal dashboard to view their contact information. You may also email SBA at 8aQuestions@sba.gov.

What will happen if SBA is not able to affirmatively determine my individual social disadvantage at this time?

- Your firm will not be eligible for new 8(a) contract awards unless and until SBA affirmatively determines your individual social disadvantage. If SBA is unable to affirmatively determine your social disadvantage in connection with a pending contract award, you will have additional opportunities to establish your individual social disadvantage. If SBA is still unable to affirmatively determine your social disadvantage, SBA will initiate suspension and/or termination proceedings.

What will happen if I decide not to submit my individual social disadvantage at this time?

- Your firm will not be eligible for new 8(a) contract awards unless and until SBA affirmatively determines your individual social disadvantage.

- SBA may initiate suspension and/or termination proceedings.

How does the Court’s ruling affect my firm’s ability to win sole source or competitive 8(a) contracts?

- With respect to 8(a) contract awards, agencies continue to offer sole source requirements to the 8(a) program. The agency contracting officer should send an offer letter to SBA nominating your firm, and at that time, SBA will verify that you have appropriately established social disadvantage if required. If you have not yet done so, SBA will contact you directly. If you have done so, SBA will confirm for the contracting officer within the acceptance letter. If your firm is participating in a competitive 8(a) award, SBA will confirm your eligibility for the award once the contracting officer has identified your firm as the apparent successful offeror.

Why is my firm suspended?

- Current 8(a) participants who did not submit a social disadvantage narrative to re-establish eligibility were suspended from the 8(a) Program on November 15, 2023. To overcome this suspension, firms must submit an individual social disadvantage narrative through Certify to re-establish eligibility. For detailed instructions, please refer to the SBA’s User Guide for Social Disadvantage Narrative Submission.

How do I overcome suspension?

- To overcome this suspension, firms must submit an individual social disadvantage narrative through Certify to re-establish eligibility. For detailed instructions, please reach out to your Business Opportunity Specialist or refer to the SBA’s User Guide for Social Disadvantage Narrative Submission.

What does suspension mean for my 8(a) firm?

- If your firm is suspended, you will no longer be eligible for 8(a) program benefits and assistance including 8(a) competitive and sole source contract support. Your program term is suspended as of the date of your Notice of Suspension. In addition, the Small Business Search is updated to reflect your firm’s status in the 8(a) program.

Guidance for current 8(a) applicants with applications in process

If you have already started an application and are working on it, you will need to include a social disadvantage narrative for each disadvantaged individual.

- If you have submitted your application, it will be returned to you by SBA. SBA will return applications on a rolling basis to request this information, along with any other information required to complete your application.

- If you have not yet submitted your application, you can immediately upload your individual social disadvantage narrative.

To provide a social disadvantage narrative under the Disadvantaged Applicant section of your 8(a) application in Certify:

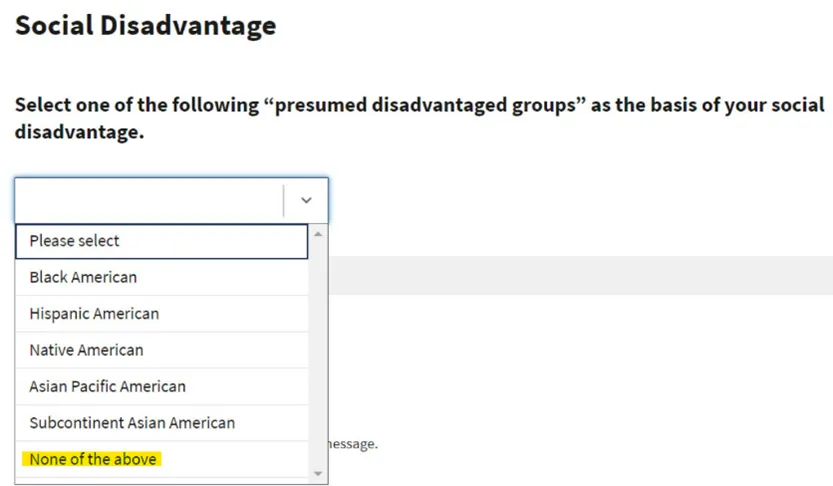

1. Select “None of the above” in response to the presumed disadvantaged group question:

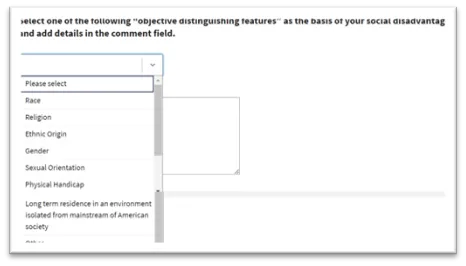

2. Detail your objective distinguishing feature:

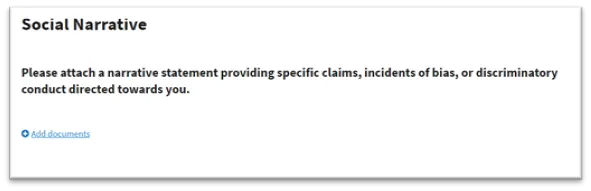

3. Upload your social disadvantage narrative:

Consistent with existing regulations, 8(a) applicants will only need to establish social disadvantage once for their program term, unless there are ownership/control or other changes which affect eligibility.

Helpful resources:

- SBA’s Guide for Writing a Social Disadvantage Narrative

- SBA’s information session webinar Social Disadvantage Narrative

The Court’s decision does not impact entity-owned firms, such as firms owned by Indian tribes, Alaska Native Corporations, Native Hawaiian Organizations or Community Development Corporations. These firms will not need to submit narratives to apply for the 8(a) program.

How can I prepare my social disadvantage narrative?

- A Guide for Writing a Social Disadvantage Narrative is available on the Certify Knowledge Base. In addition, you are encouraged to review SBA’s webinar session 8(a) information videos.

Can I use examples of social disadvantage from any point in my life?

- Yes, the examples you include in your social disadvantage narrative can be related to any time in your life but must include detail of how the incident impacted your entry or advancement in the business world. You may include examples that have taken place before or after you started your 8(a) participation.

If SBA determines that my social disadvantage narrative does not have enough detail, will I get a chance to revise my narrative?

- Yes, you will have an opportunity to provide more detail.

I am confused about the required format for the social disadvantage narrative. Is a letter required, or can I follow the guide and submit bullet points?

- There are no specific format requirements. Please review SBA’s Guide for Writing a Social Disadvantage Narrative available from the Certify Knowledge Base.

Guidance for potential 8(a) applicants interested in applying to the 8(a) program

As of September 29, 2023, SBA has reopened the 8(a) application for new applicants. SBA has updated the application by adding a plain language fillable questionnaire for applicants to identify social disadvantage. Firms continue to have the option to prepare a social disadvantage narrative and upload it directly to Certify.

Potential applicants are encouraged to access the Certify Knowledge Base for information and tips for submitting a successful application.

Individual-owned firms

- To start a new 8(a) application, please visit MySBA Certifications to create your account and claim your business. Active certifications should be still managed through Certify.

Entity-owned firms (firms owned by Indian tribes, Alaska Native Corporations, or Native Hawaiian Organizations)

- The updated application process does not apply to entity-owned firms, such as firms owned by Indian tribes, Alaska Native Corporations, Native Hawaiian Organizations or Community Development Corporations. These firms will not need to submit narratives to apply for the 8(a) program.

Frequently asked questions for potential applicants

How can I prepare my social disadvantage narrative?

- A Guide for Writing a Social Disadvantage Narrative is available on the Certify Knowledge Base. In addition, you are encouraged to review SBA’s webinar session 8(a) information videos.

Can I use examples of social disadvantage from any point in my life?

- Yes, the examples you include in your social disadvantage narrative can be related to any time in your life but must include detail of how the incident impacted your entry or advancement in the business world. You may include examples that have taken place before or after you started your 8(a) participation.

Guidance for federal agencies

Federal agencies are encouraged to access resources SBA has made available via the OMB Max.gov collaboration site. That site is receiving daily updates and is the best source for up-to-date information for the federal acquisition workforce.

SBA published guidance to federal agencies on August 18, 2023.

SBA also has published FAQs intended to help the federal acquisition workforce community as it implements SBA’s guidance.

Helpful resources:

- Visit SBA’s OMB Max.gov collaboration page for current guidance and FAQs.

- Note: As of March 26, 2024, SBA's 8(a) Social Disadvantage Qualification List will no longer appear on MAX.gov. All 8(a) participants appear on SBA’s Small Business Search (SBS, formerly the Dynamic Small Business Search), and are available for 8(a) contracts unless designated as “suspended”.

- SBA’s Guidance to Federal Agencies from August 18, 2023

- FAQs for Federal Agencies from September 19, 2023