Content

Prepare for a new market

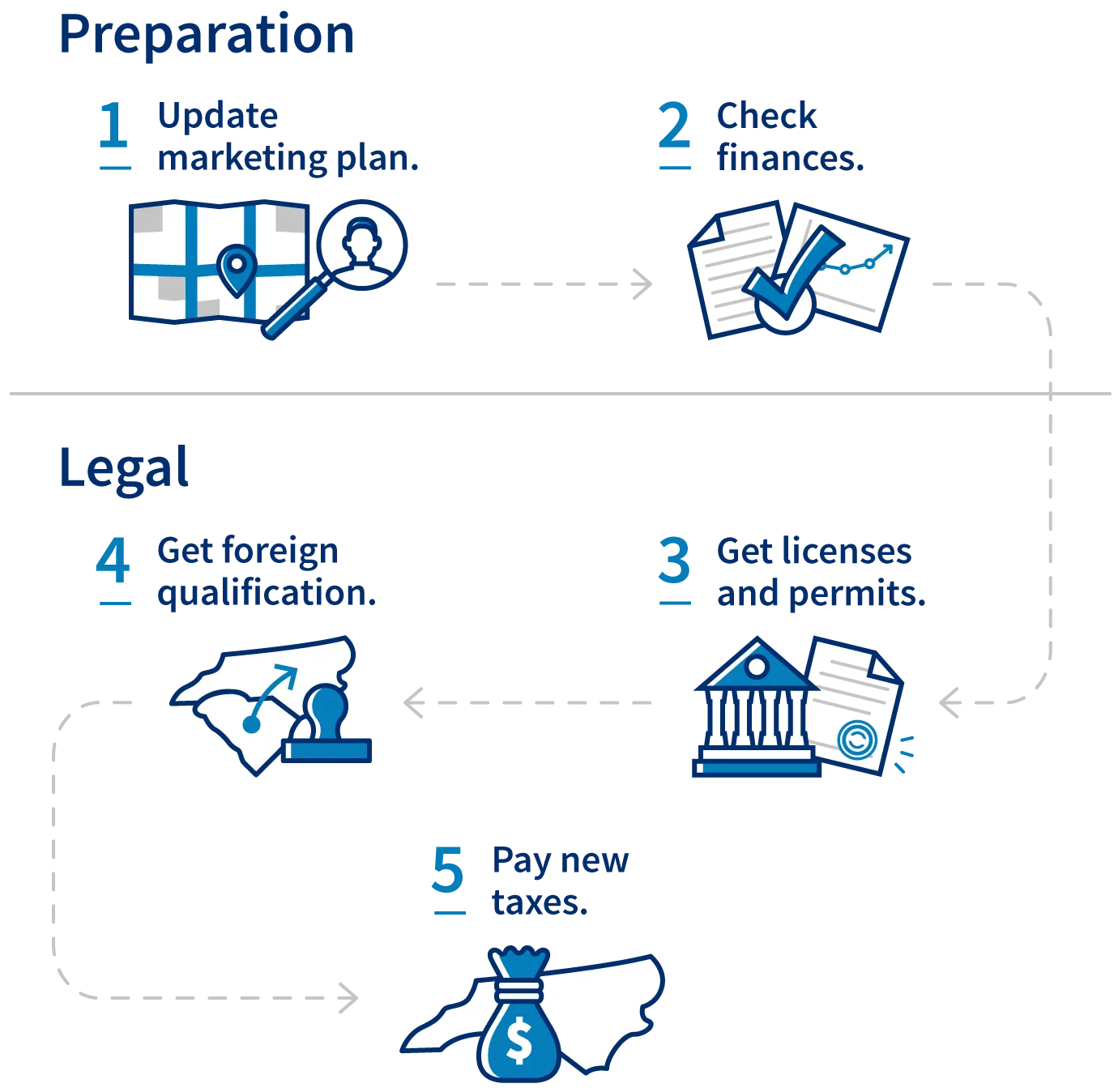

First, update your marketing plan with your new location in mind. Think about your target customer, sales plan, and competitive advantage. Add up any additional marketing and sales costs. Make sure your updated marketing plan is just as thorough as your initial plan.

Compare your business to the competition, learn about the local market, and get a sense of the advertising market.

Next, review your business finances. Build a forecast that projects estimated costs and estimated revenue for your new location. Take a close look at your balance sheet to make sure you can cover the costs of expanding. If you don’t have enough capital, you can try to get more funding.

Legal steps to expand your business

Expanding your business to a new state, county, or city isn’t very different from opening a new business there. You’ll want to make sure you register your business with the right agencies and pay the appropriate taxes.

License, permit, and zoning rules

These rules vary across states and localities. Getting licenses and permits in new locations is similar to getting them in your home state.

If you already have a permit or license from a federal agency, check with the issuing agency to confirm you can legally operate in a new state. Also, see whether your new state, county, and city governments require a new license or permit. Start by visiting your state's website.

Foreign qualification

If you plan to expand your business to a new state, you might need to file for foreign qualification in that state. This process notifies the new state that your business is active there.

To foreign qualify, file a Certificate of Authority. Many states also require a Certificate of Good Standing from your state of formation. Each state charges a filing fee, but the amount varies by location and business structure.

Check with state offices to find out foreign qualification requirements and fees.

Pay taxes in new states and localities

If you do business in a new state as a foreign qualified business, you’ll typically need to pay taxes and annual report fees in the new state as well as your home state. The process for foreign qualified businesses to pay taxes is similar to any other business that needs to pay taxes in the state.

Keep in mind that not every state and locality has a sales tax. In addition, most states have tax exemptions on certain items, such as food or clothing. If you charge sales tax, you need to be familiar with applicable rates.

Pay taxes for online sales

If your business has a physical or economic presence in a state — such as a physical location, employees or a certain amount of income — you may have to collect applicable state and local sales tax from your customers in that state. This presence is called a 'nexus'. Most states have different standards for what establishes a nexus.

Determining which sales tax to charge can be a challenge. Many retailers use online shopping cart software that automatically calculates sales tax rates. Make sure your sales plan accounts for the various state rates. Call your state's Department of Revenue or local District Office to make sure you know what your state requires.

Franchising

There are two primary ways you could expand your business with franchising.

The first way is to buy an existing business or franchise. This option tends to cost more upfront, but can be less risky than trying to start from scratch.

The second way is to build your own franchise. Businesses that are good candidates for franchising have a few traits in common.

- Product or service is superior and appeals to potential business owners

- Concept and operations are easy to teach

- Business is easy to duplicate in new markets

The federal government and many states have requirements that must be met in order for you to sell franchises, so you may want to hire an attorney. Once you've begun franchising, some states remain active in the relationship between you and your franchisees by monitoring territorial rights or limiting the transfer and renewal of your franchises.

Franchising has more costs than many other types of businesses. You’ll probably need to pay lawyers, accountants, and advertising staff. Don't forget about training the employees and building systems you'll need to run the franchise.